Lumen has been the hardest large big telco to figure out. Verizon, AT&T, Frontier, Windstream, and others have clearly decided that building fiber is the future path to survival. Consequently, the other telcos are far ahead of Lucent in terms of fiber passings. In the recent investor webcast, CEO Kate Johnson talked about Lumen’s upcoming fiber plans. In doing so, she mentioned that Lumen only covers 12% of its passings with fiber – far behind the other telcos.

Lumen has been the hardest large big telco to figure out. Verizon, AT&T, Frontier, Windstream, and others have clearly decided that building fiber is the future path to survival. Consequently, the other telcos are far ahead of Lucent in terms of fiber passings. In the recent investor webcast, CEO Kate Johnson talked about Lumen’s upcoming fiber plans. In doing so, she mentioned that Lumen only covers 12% of its passings with fiber – far behind the other telcos.

CenturyLink was one of the first big telcos after Verizon to embrace fiber. In 2017, under CEO Glen Post, the company had plans to pass 900,000 homes and businesses with fiber, with similar plans in upcoming years. Post, with a long telco background, had a clear vision of CenturyLink becoming a fiber-based ISP, at least in the many large cities it served.

However, at the end of 2017, the company took a sharp turn when it acquired Level 3. To nobody’s surprise, Jeff Storey from Level 3 took over as CEO, and the company changed its focus from residential fiber expansion to a focus on large business customers and small cell sites – the bread and butter of Level 3. By 2019, new fiber construction had dropped to 300,000 passings, with many of those coming from connecting large buildings to the network.

In 2020, the company’s stated focus was on adding large buildings to the network, and the company added 18,000 buildings to its fiber network, while only passing 400,000 total new fiber passings. That’s a low number of new fiber passings for a company that had 4.5 million broadband customers that year. 2020 was also the year when the company rebranded to become Lumen, a move to distance itself from identification as a copper telco.

Instead of expanding fiber, Lumen decided to ditch copper assets and announced the sale of its last-mile networks in twenty states to Apollo Global Management in 2021. This brought a cash infusion needed for expansion and got rid of deteriorating copper networks.

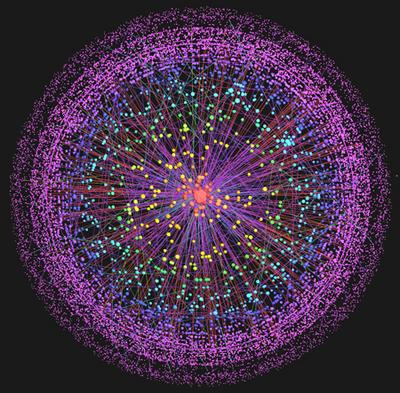

Last year the company announced that its major expansion thrust was to beef up its large intercity fiber network across the country, with the goal of adding over 6 million miles of fiber strand by 2026. The original CenturyLink fiber network was starting to show some age, with many routes built forty years earlier. The company planned to upgrade to the newest fiber from Corning that can support 400-gigabit electronics. The new long-haul networks have fiber bundles between 432 and 864 fiber strands – much larger than the historical networks that had 96 to 144 fibers.

Lumen has been penalized by the many changes in its future direction by seeing the stock price go into the tank. CenturyLink stock peaked at almost $49 in 2007. By 2017, the stock had slipped to the mid-$20 range. Since then, the stock has dropped steadily and recently hit $1.80 per share after sitting at $10 per share a year earlier.

CEO Kate Johnson admitted that the company needs to do something different. The company eliminated its dividends to shareholders in the fourth quarter of 2022. The company is instead going to reinvest that money into building new fiber passings and has plans this year to connect 500,000 homes and businesses in 2023. It plans to build deeply into six major metro areas this year.

The company needs to reinvent itself. Lumen lost 253,000 broadband customers in 2022 – 7.7% of its broadband base. The company lost another 56,000 broadband customers in the first quarter this year, dropping the company to fewer than 3 million broadband customers while falling to be the eighth largest ISP after being surpassed by T-Mobile.

It’s not hard to understand, in retrospect, why the company has lost value. The company has seemingly reinvented itself every year since 2017 by changing its primary focus each year. Some of the changes, like adding more business buildings and beefing up the long-haul fiber network will likely generate a lot of cash and value in the long run. But Wall Street has clearly told the company to pick a future and stick to it.